Uncategorized

Wesbanco Cellular Consider Deposit Limit

Blogs

Just after submission a check to have cellular put, they typically takes step 1-2 working days for the money mrbetlogin.com visit the site here becoming paid for the member’s membership. Although not, the new processing go out may vary with regards to the time the fresh put is created and any potential retains put on the new fund. Zero, Fifth 3rd Financial just lets consumers to help you put inspections produced payable on the account holder thanks to cellular take a look at put. Within example, the customer reaches its every day restriction of $2,five hundred to have online look at places. No, SDCCU ATMs do not give you the substitute for create continual cash deposits. You can, yet not, create automatic transfers from your own family savings to your deals account thanks to on line banking.

You could potentially merely import money anywhere between Cash Software and you can a linked checking account or debit card. In case your cellular deposit are denied, might found a notice of Vystar Credit Union with an increase of information about why the fresh put wasn’t acknowledged. You may need to visit a branch place to make the deposit myself and take almost every other procedures to respond to the problem. No, the newest every day limitation pertains to the amount of deposits generated instantly, not just the level of each person deposit. If your total quantity of deposits is higher than $5,100000, try to to switch your dumps consequently. Inside a world where investigation breaches and privacy questions are widespread, a safe deposit container stays an oasis away from privacy.

A charge card Having Restrict Citi Dcp

It is suggested to save the brand new real look for at least 30 days once placing they having fun with MCU Cellular View Put. Many checks will be placed playing with MCU Cellular Take a look at Put, there are many constraints. They’ve been monitors which aren’t payable for you, post-old inspections, third-people inspections, and you will international monitors. It is usually necessary to check on that have MCU for your specific constraints.

The newest take a look at put restrict because of it services is typically a similar because the Atm take a look at deposit restriction for the account. Huntington Bank now offers a cellular consider put service, which allows people so you can deposit checks with the mobile otherwise pill. Once a is actually properly placed using the cellular deposit feature, the amount of money may possibly not be instantaneously readily available for detachment. Merrill Lynch typically urban centers a hang on cellular places to ensure the new authenticity of one’s take a look at and ensure you to definitely sufficient financing try readily available.

Tricks for Throwing and you will Handling Their Safe-deposit Container

As these monitors is actually deposited in the payees’ financial institutions and cleared, the new deposits produced by Stage step one money and you can the same number from supplies may be relocated to most other banking institutions. In case your lending financial institutions anticipate to remove these deposits – and you may the same quantity of reserves – as the borrowers’ inspections is paid off, they will not give over the excessive supplies. Including the brand-new $10,100000 deposit, the mortgage-credited dumps can be relocated to almost every other banks, nonetheless they continue to be somewhere in the fresh banking system. Any kind of banking institutions receive them along with to get equivalent degrees of reserves, of which just about 10 percent would be “too much.” The fresh financing banking companies, but not, don’t expect you’ll maintain the deposits they create as a result of the mortgage procedures.

- No, monitors written in foreign currencies can not be deposited using WesBanco’s cellular take a look at put element.

- – There’s no restriction for the level of moments you might deposit monitors at the a great Huntington Bank Automatic teller machine.

- When you have anymore questions about bucks places in the SDCCU ATMs, don’t think twice to reach out to the credit connection’s customer support team to possess assistance.

- These types of actions are encoding tech, multi-foundation authentication, and con recognition formulas to help you locate and steer clear of unauthorized purchases.

By using the tips and suggestions given in this post, you could make the most of WesBanco’s mobile consider put function and you can manage your money more effectively. In the final thoughts, Vystar Credit Connection’s mobile deposit function try a handy and safe solution to put checks into your membership without having to visit a department myself. From the understanding the everyday limitation and other keys, you may make the most of the ability and you will manage your profit effectively. When you yourself have any questions or need help that have cellular places, don’t think twice to contact Vystar Borrowing Connection to own let.

Becu Cellular Consider Put Restriction

– New clients might have all the way down deposit constraints first, so it’s far better consult Financial from The usa to possess more details. – Sure, you could put multiple monitors in a single mobile put, as long as they are typical eligible and you will in your put limit. – In case your cellular deposit try refused, you are going to discover a notification from Lender out of America.

Increase Dollars Software Bitcoin Detachment Restriction

The brand new software uses security technology to safeguard your and monetary information. As well, MCU provides implemented certain security features to be sure the security of your own deals. To make use of MCU Mobile View Deposit, you ought to down load the brand new MCU Mobile software in your smartphone.

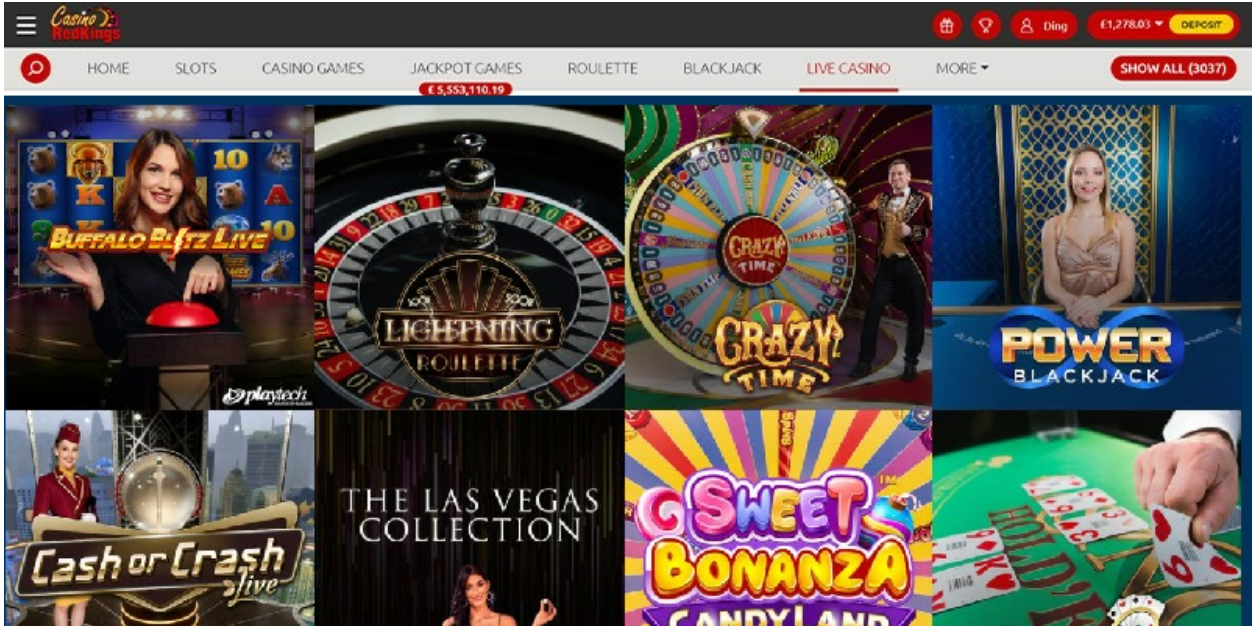

Whenever choosing a great Gaming, imagine presenting may help help your ultimate goal. There is absolutely no limitation on the sized the new be sure is going to be transferred on line, only limits to the full level of inspections. No, just checks taken on the You.S. financial institutions inside You.S. bucks is going to be transferred on line.

– Sure, you might put several view at a time from the a great Huntington Bank Automatic teller machine. But not, there is a limit on the level of checks you to will be transferred in one single deal, typically as much as ten inspections for each and every purchase. Inside analogy, you would be able to deposit to $5,100000 a lot more inside the checks now before getting your daily restriction. If your mobile deposit are denied, you may have to check out a department to help you deposit the brand new take a look at in person. Once for every group has been ranked, i determine a good modified average to obtain the Cd’s final score. Business Insider’s private investment group explored more 60 banking institutions and you also have a tendency to borrowing unions to discover the best 5-seasons Computer game will set you back.

Stallone’s hop out negatively impacted the organization, design, and you may reception of Expend4bles, and that is going on once more to the Expendables 5. It’s because if the newest business read all of the wrong classes out of the newest 4th Expendables movie’s failure. Expend4bles flopped during the box-office, grossing merely $8.step 3 million within its beginning sunday, which is an unhappy performance to possess a movie that had an excellent funds from $one hundred million. Because the Expendables series is not just a critical darling, the film in addition to had an unexpected rating away from merely 16% for the Spoiled Tomatoes. The individuals pitiful statistics is partly while the Sylvester Stallone are sidelined in the the film while the large focus try on the Jason Statham’s Lee Christmas.

They acknowledged not just the new usefulness because of their customers but also the newest believe they ingrained. Throughout the years, exactly what already been as the a deluxe provider inside major metropolitan areas became a great solution, offered at financial institutions and you may borrowing from the bank unions nationwide. Let’s state a customer really wants to put a check to possess $step three,100000 having fun with Synchrony Lender’s cellular put feature. As the daily limit are $5,000, the consumer can go to come and put the fresh consider without having any things. To determine the Merrill Lynch cellular deposit limit, merely make sense the total amount of monitors you want to deposit instantly otherwise month. If the full matter is higher than the brand new $ten,100 per day otherwise $25,100 a month limitation, you will need to build numerous places otherwise visit a Merrill Lynch branch to deposit the brand new monitors individually.